Predicting Stock Market Trends

Published on September 14, 2024

This project focuses on leveraging data science and machine learning techniques to predict stock market trends. The complex and dynamic nature of financial markets makes accurate predictions challenging, yet essential for investors, analysts, and businesses. By exploring a range of traditional and modern analytical approaches, including AI-driven methods, this project aims to enhance the ability to forecast market movements and make informed financial decisions.

Introduction

The stock market is a fundamental component of global finance, driven by various factors such as economic indicators, investor sentiment, and geopolitical events. This project delves into the intricacies of market behavior, exploring how different analytical methods can be used to predict stock price movements. The goal is to better understand market dynamics and assess the effectiveness of various prediction techniques, from classic theories to advanced AI models.

Objective

The main objective of this project is to evaluate the performance of different analytical approaches in predicting stock market trends. By examining both traditional and AI-driven methods, the project aims to identify the strengths and limitations of each approach, ultimately determining how machine learning can enhance market prediction capabilities.

Key Components

- Theoretical Foundations: The project explores key financial theories, such as the Efficient Market Hypothesis (EMH) and Random Walk Theory (RW), which provide foundational insights into market efficiency and predictability. These theories are contrasted with more modern perspectives that consider investor behavior and market anomalies.

- Traditional Analytical Techniques: Various traditional methods, including technical analysis and fundamental analysis, are examined. These approaches rely on historical price data, financial statements, and market metrics to forecast future market movements.

- Artificial Intelligence and Machine Learning: The project leverages AI techniques, such as neural networks, reinforcement learning, and natural language processing (NLP), to analyze vast amounts of financial data. These methods are used to model complex relationships and detect patterns that traditional approaches may miss.

- Quantitative Models: Mathematical and statistical models, such as ARIMA, SARIMA, and Long Short-Term Memory (LSTM) networks, are used to analyze time series data and forecast market trends. These models are particularly useful for capturing temporal dependencies and seasonal effects in financial data.

Technologies and Tools Utilized

- Python: Used as the primary programming language for implementing the various analytical and machine learning models.

- Pandas and NumPy: Utilized for data manipulation, preprocessing, and analysis of financial datasets.

- Scikit-learn: Provides tools for implementing traditional machine learning models such as regression and classification algorithms.

- TensorFlow and Keras: Employed for building and training neural networks, particularly deep learning models like LSTM and reinforcement learning frameworks.

- Matplotlib and Seaborn: Used for data visualization, helping to analyze model performance and understand trends in the financial data.

Functionalities

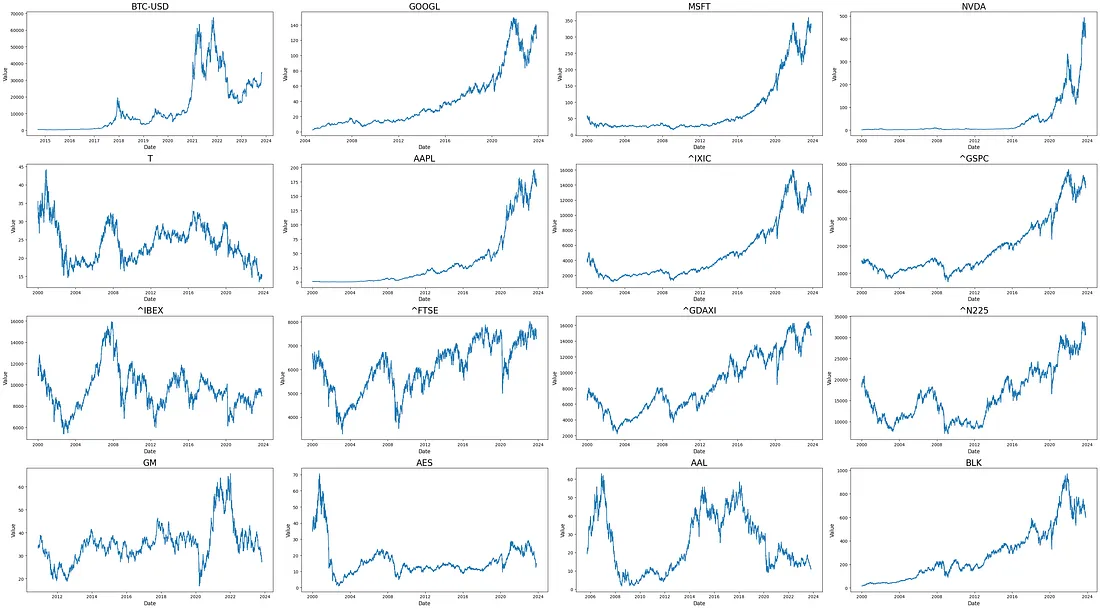

- Data Collection and Preprocessing: The project involves collecting financial data, including historical prices, trading volumes, and economic indicators. The data is then preprocessed for analysis, involving steps like normalization, feature extraction, and handling missing values.

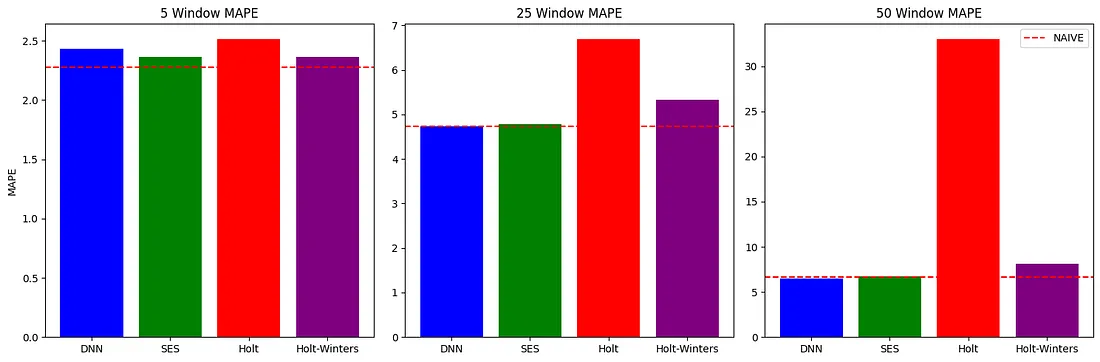

- Model Evaluation: Various models are evaluated based on their ability to predict stock market trends accurately. Metrics such as mean squared error, accuracy, and precision are used to assess the performance of each approach.

- Predictive Analysis: The project applies predictive models to generate forecasts of stock prices and market movements. The results are compared across different techniques to identify the most effective methods.

- Algorithmic Trading Simulation: AI-driven trading strategies are simulated to assess their real-world applicability. This includes backtesting various trading algorithms to measure potential profitability and risk.

Challenges and Learning Outcomes

The project addresses significant challenges, including the high volatility and unpredictability of financial markets. Key learning outcomes involve understanding the limitations of traditional analytical techniques, the potential of AI to improve predictive accuracy, and the importance of data quality and preprocessing in financial modeling.

Future Enhancements

- Integration of More Complex AI Models: Expand the project by integrating more sophisticated AI models, such as Proximal Policy Optimization (PPO) or Generative Adversarial Networks (GANs) for enhanced prediction capabilities.

- Real-Time Data Analysis: Implement real-time data streaming and analysis to enable immediate market predictions and live trading simulations.

- Risk Assessment Tools: Develop tools to assess the risk associated with different investment strategies, incorporating predictive models to gauge market volatility and potential losses.

This project provides a comprehensive approach to understanding and predicting stock market behavior through a combination of traditional and AI-driven methods. By continuously refining the models and expanding the scope of analysis, the project aims to contribute valuable insights to the field of financial market prediction and decision-making.